As Deepak Nitrite Share Forecast for Long-Term Investors takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Deepak Nitrite, a company with a promising outlook, has garnered attention from long-term investors seeking to understand the dynamics of its share forecast. In this insightful discussion, we delve into the various aspects influencing the future performance of Deepak Nitrite shares.

Overview of Deepak Nitrite Share Forecast

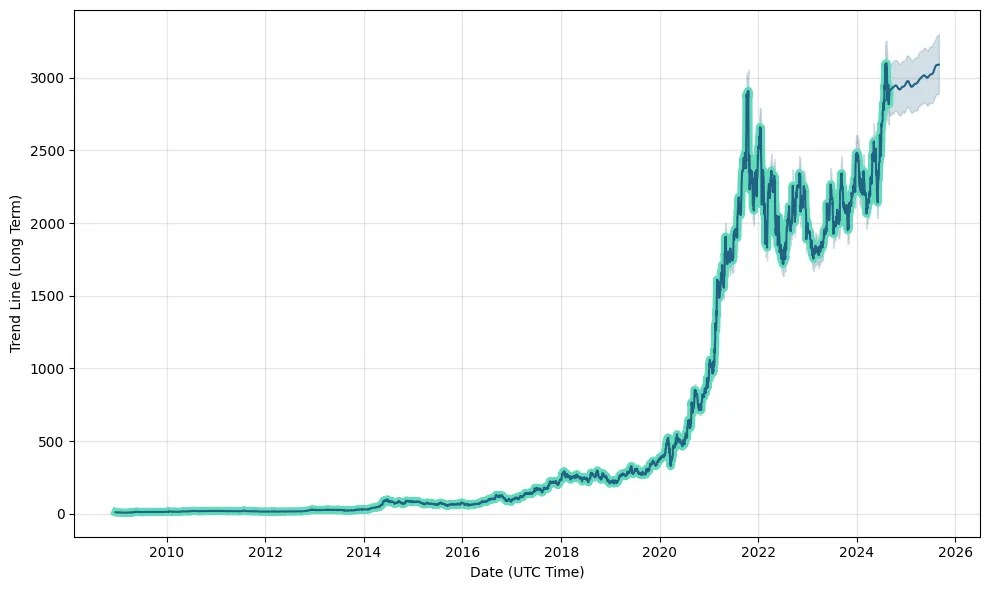

Deepak Nitrite shares have been performing well in the market, showing steady growth over the past few months. The company has managed to maintain a strong position amidst market fluctuations.

Current Performance

- The share prices of Deepak Nitrite have seen a consistent upward trend, reflecting investor confidence in the company.

- Recent quarterly reports have indicated a healthy revenue growth for Deepak Nitrite, showcasing the company's resilience in the market.

- The company's market capitalization has also increased, signaling positive sentiments among investors.

Recent Trends and Developments

- Deepak Nitrite has recently announced expansion plans for its manufacturing facilities, which could lead to increased production capacity and revenue in the future.

- The company's focus on innovation and sustainability has garnered attention from environmentally-conscious investors, potentially driving up share prices.

Financial Health and Impact on Share Forecast

- Deepak Nitrite's strong financial performance, with healthy profit margins and cash reserves, bodes well for its future growth prospects.

- The company's ability to adapt to changing market dynamics and maintain a competitive edge is likely to support a positive share forecast for long-term investors.

Factors Influencing Deepak Nitrite Share Forecast

Investing in Deepak Nitrite shares requires an understanding of the various factors that can influence the share forecast. These factors range from market conditions and industry trends to company-specific events and global economic conditions.

Market Conditions and Industry Trends

Market conditions and industry trends play a significant role in determining the performance of Deepak Nitrite shares. Factors such as demand-supply dynamics, regulatory changes, and technological advancements can impact the company's revenue and profitability. Keeping an eye on these trends can help investors make informed decisions regarding their investment in Deepak Nitrite.

Global Economic Conditions

Global economic conditions, including factors like interest rates, inflation, and geopolitical events, can have a profound impact on Deepak Nitrite share prices in the long term. For example, a slowdown in the global economy may lead to reduced demand for the company's products, affecting its financial performance and stock price.

Investors should consider these macroeconomic factors when evaluating the potential risks and returns associated with investing in Deepak Nitrite.

Competitive Landscape

The competitive landscape in which Deepak Nitrite operates can also influence its future performance. Competitor actions, market share dynamics, and pricing strategies can all impact the company's market position and profitability. By analyzing the competitive landscape, investors can gain insights into the challenges and opportunities that Deepak Nitrite may face in the future.

Long-Term Investment Prospects for Deepak Nitrite Shares

When evaluating the potential for long-term investors in Deepak Nitrite shares, it is important to consider various factors that can impact the company's growth and sustainability.

Comparison with Industry Peers

Deepak Nitrite's growth prospects can be compared with its industry peers to make informed long-term investment decisions. By analyzing the company's performance relative to competitors, investors can gain insights into its position within the industry and potential for future growth.

Sustainability of Business Model

The sustainability of Deepak Nitrite's business model plays a crucial role in determining long-term share value appreciation. Investors should assess the company's ability to adapt to changing market conditions, innovate, and maintain profitability over an extended period

Risk Factors to Consider for Long-Term Investment in Deepak Nitrite Shares

Investing in Deepak Nitrite shares for the long term can offer significant returns, but it is important to be aware of the potential risks involved. Understanding these risks and implementing strategies to mitigate them is crucial for protecting your investment.

Regulatory Changes

Regulatory changes in the chemical industry can have a direct impact on Deepak Nitrite's operations and profitability. Changes in environmental regulations, safety standards, or trade policies can affect the company's ability to operate efficiently and could lead to increased costs or compliance issues.

Geopolitical Events

Geopolitical events such as trade disputes, conflicts, or changes in government policies can create uncertainty in the market and impact Deepak Nitrite's share prices. For example, disruptions in the supply chain due to geopolitical tensions can affect the company's production and distribution capabilities.

Market Volatility

Market volatility, especially in the chemical sector, can lead to fluctuations in Deepak Nitrite's share prices. Factors such as changes in raw material prices, demand-supply dynamics, or global economic conditions can influence the market sentiment and impact the company's stock performance.

Strategies to Mitigate Risks

To mitigate risks associated with investing in Deepak Nitrite shares, long-term investors can consider diversifying their portfolio, staying informed about industry trends and developments, setting clear investment goals, and regularly reviewing their investment strategy. Additionally, implementing stop-loss orders or using hedging techniques can help protect against sudden market fluctuations.

Last Point

In conclusion, the forecast for Deepak Nitrite shares presents a mix of opportunities and risks for long-term investors. By carefully considering the factors discussed, investors can make informed decisions to navigate the market landscape and potentially reap the benefits of investing in this company.

FAQ

What are some recent trends influencing Deepak Nitrite share prices?

Recent trends such as increased demand for the company's products or changes in raw material prices can impact Deepak Nitrite share prices.

How does the global economic outlook affect Deepak Nitrite share prices in the long term?

The global economic conditions, such as GDP growth or trade agreements, can have a significant impact on Deepak Nitrite share prices over the long term.

What are some risk factors to consider when investing in Deepak Nitrite shares for the long term?

Risk factors include regulatory changes, market volatility, and geopolitical events that can affect the performance of Deepak Nitrite shares in the long term.