Delve into the intricate world of Narayana Hrudayalaya Stock as we uncover its past, present, and potential future. Brace yourself for a journey filled with financial analysis, market trends, and growth prospects that will keep you on the edge of your seat.

Explore the financial performance, market competition, and expansion plans of Narayana Hrudayalaya Stock in this detailed discussion.

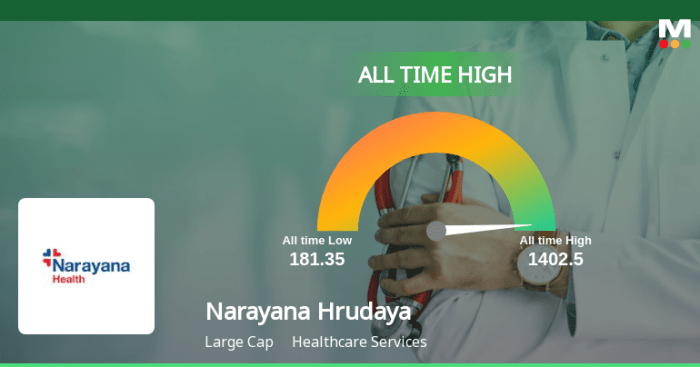

Overview of Narayana Hrudayalaya Stock

Narayana Hrudayalaya is a leading healthcare provider in India, specializing in cardiac care and other medical services. Founded in 2000 by Dr. Devi Shetty, the hospital chain has grown to become one of the largest in the country, with a strong focus on affordable healthcare for all.In the stock market, Narayana Hrudayalaya is listed on the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE).

The company's stock performance has been influenced by various factors, including industry trends, financial results, and overall market conditions.

Current Position of Narayana Hrudayalaya in the Stock Market

Narayana Hrudayalaya's stock has shown resilience in the face of market fluctuations, reflecting its stable position in the healthcare sector. The company's consistent growth in revenue and patient volumes has garnered investor confidence, contributing to a positive outlook for its stock performance.

- Narayana Hrudayalaya's stock price has exhibited steady growth over the past few years, outperforming many of its competitors in the healthcare industry.

- The company's expansion into new markets and strategic partnerships have bolstered its market presence and attracted investor interest.

- Investor sentiment towards Narayana Hrudayalaya remains positive, with analysts forecasting continued growth for the company based on its strong fundamentals and growth prospects.

Investors are closely monitoring Narayana Hrudayalaya's performance in key operational areas such as patient admissions, revenue per bed, and cost management to assess its long-term sustainability and growth potential.

Factors Influencing the Stock Performance of Narayana Hrudayalaya

Narayana Hrudayalaya's stock performance is influenced by a combination of internal and external factors that impact the healthcare industry and the company's operations.

- Industry Trends: Changes in healthcare regulations, technological advancements, and competitive landscape can affect Narayana Hrudayalaya's stock price.

- Financial Results: Quarterly earnings reports, revenue growth, and profitability margins play a crucial role in determining investor confidence and stock performance.

- Market Conditions: Economic factors, investor sentiment, and overall market volatility can impact the stock price of Narayana Hrudayalaya, along with broader market trends.

Financial Performance Analysis

When analyzing the financial performance of Narayana Hrudayalaya, it is important to look at key financial statements and indicators to understand the company's financial health and growth potential.

Revenue Growth

Over the past few years, Narayana Hrudayalaya has shown consistent revenue growth, indicating a positive trend in the company's earnings. The revenue growth can be attributed to the expansion of healthcare services, increased patient volume, and strategic partnerships.

Profitability Ratios

Profitability ratios provide insights into how efficiently a company is generating profits from its operations. Narayana Hrudayalaya's profitability ratios, such as gross profit margin, operating profit margin, and net profit margin, reflect the company's ability to manage costs and generate profits.

A consistent improvement in these ratios indicates a healthy financial performance and effective cost management strategies.

Market Trends and Competition

In the dynamic healthcare sector, Narayana Hrudayalaya faces competition from various key players. Understanding market trends is crucial in analyzing how these factors impact the stock price of Narayana Hrudayalaya.

Key Competitors

- Apollo Hospitals

- Fortis Healthcare

- Manipal Hospitals

Narayana Hrudayalaya competes with well-established healthcare providers like Apollo Hospitals, Fortis Healthcare, and Manipal Hospitals in the industry.

Market Impact on Stock Price

- Market trends such as technological advancements, government policies, and healthcare regulations can influence investor sentiment towards Narayana Hrudayalaya.

- Changes in patient demographics, healthcare spending, and global health crises can also affect the stock price of Narayana Hrudayalaya.

Investors closely monitor market trends and developments in the healthcare sector to gauge the potential impact on Narayana Hrudayalaya's stock performance.

Market Share and Positioning

- Narayana Hrudayalaya holds a significant market share in cardiac care and specialty healthcare services.

- Compared to its competitors, Narayana Hrudayalaya focuses on providing affordable and quality healthcare services, which sets it apart in the market.

By emphasizing cost-effective healthcare solutions and maintaining a strong reputation for quality care, Narayana Hrudayalaya has strategically positioned itself in the competitive healthcare landscape.

Growth Prospects and Expansion Plans

Investors are keen to know about the growth prospects and expansion plans of Narayana Hrudayalaya as these factors can significantly impact the stock value. Let's delve into the future outlook for the company.

Expansion Plans

Narayana Hrudayalaya has been actively pursuing expansion opportunities to broaden its reach and enhance its service offerings. One of the key expansion plans includes setting up new hospitals in various regions to cater to the growing healthcare needs of the population.

By expanding its network, the company aims to increase its market share and establish itself as a leading player in the healthcare industry.

- Opening of new specialty centers: Narayana Hrudayalaya is planning to establish specialized centers focusing on areas such as oncology, neurology, and orthopedics to provide comprehensive healthcare services to patients.

- Exploring international markets: The company is also looking to expand its presence in international markets by entering into strategic partnerships or acquisitions to tap into new patient segments and diversify its revenue streams.

- Investing in technology and infrastructure: To support its expansion plans, Narayana Hrudayalaya is investing in advanced technology and upgrading its infrastructure to ensure high-quality patient care and operational efficiency.

Potential Risks and Challenges

While the expansion plans of Narayana Hrudayalaya present exciting growth opportunities, there are also potential risks and challenges that could impact the company's future growth trajectory.

One of the risks includes regulatory hurdles and compliance issues that may arise when expanding into new markets or launching new projects.

- Intense competition: The healthcare industry is highly competitive, and Narayana Hrudayalaya faces competition from both established players and new entrants. Maintaining market position and pricing competitiveness could pose challenges.

- Financial constraints: Funding expansion projects and new initiatives require significant capital investment, and any constraints in accessing funding or managing debt could hinder the company's growth plans.

- Talent acquisition and retention: As the company expands its operations, attracting and retaining skilled healthcare professionals becomes crucial. A shortage of qualified staff could impact the quality of patient care and operational efficiency.

Last Recap

As we wrap up our exploration, it's evident that the future of Narayana Hrudayalaya Stock holds both challenges and opportunities. Stay tuned for more updates on this dynamic stock in the ever-evolving market landscape.

Key Questions Answered

What is the history of Narayana Hrudayalaya?

Narayana Hrudayalaya was founded in 2000 by Dr. Devi Shetty and has since grown to become one of the leading healthcare providers in India.

How does market competition affect Narayana Hrudayalaya's stock price?

Market competition can impact Narayana Hrudayalaya's stock price by influencing investor sentiment and market share dynamics.

What are the potential risks for the future growth of Narayana Hrudayalaya?

Potential risks include regulatory changes, economic downturns, and unexpected shifts in the healthcare sector.